See the apartment

Why Investing in Real Estate in Poland in 2024 is a Safe and Wise Choice – Analysis of the UBS Global Real Estate Bubble Index 2024

Introduction:

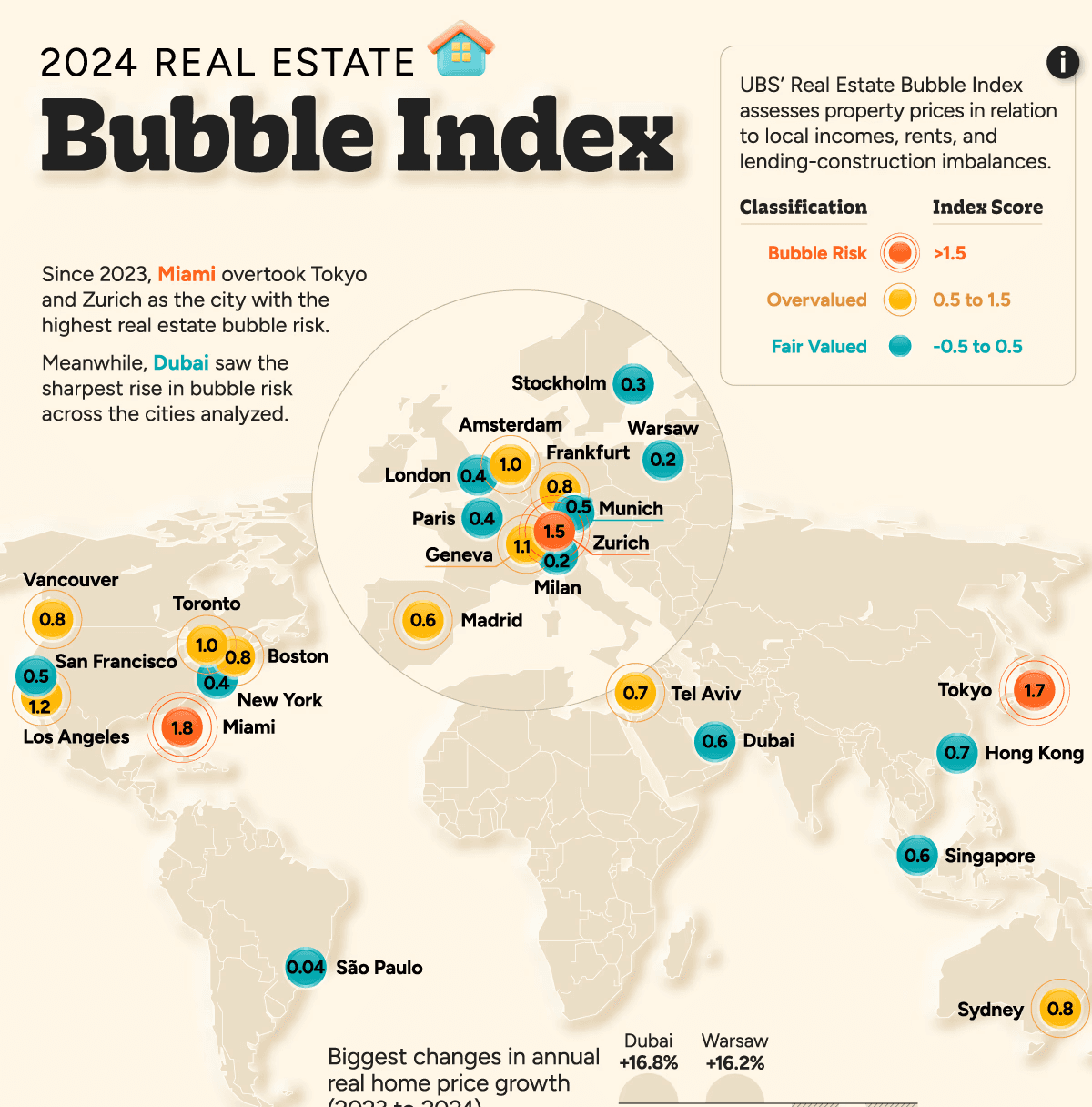

The year 2024 presents many challenges on the global real estate market, and many investors are seeking safer alternatives for their investments. The UBS Global Real Estate Bubble Index 2024 indicates rising bubble risks in many mature markets. However, the real estate market in Poland remains exceptionally stable, offering secure investment conditions compared to countries like Spain and the USA, where the risk of a bubble bursting is increasing. In this article, we will explore why Poland represents a wise choice for investors in 2024.

Table of Contents:

Global Real Estate Market Situation in 2024 – What the UBS Report Shows

Poland Compared to Europe – Why Investing in Poland is Safe

Stability of the Real Estate Market in Poland – Key Data and Numbers

Advantages of Poland over Other Countries like Spain and the USA

Conclusions and Recommendations for Investors

1. Global Real Estate Market Situation in 2024 – What the UBS Global Real Estate Bubble Index 2024 Shows

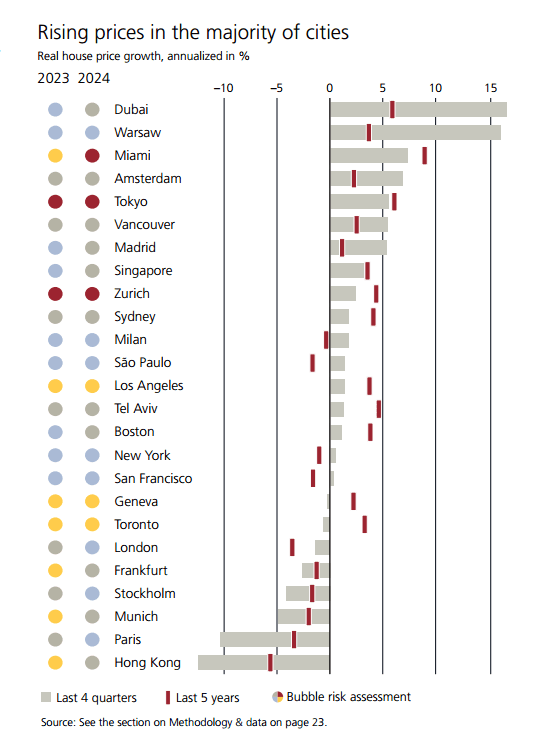

The global real estate market in 2024 shows strong signs of bubble risk in certain cities, raising concerns among investors. The UBS Global Real Estate Bubble Index highlights cities like Miami, Tokyo, and Los Angeles, where property prices have risen by as much as 50% since 2019, which could lead to a bubble burst in the coming years.

In Europe, cities like Zurich and Amsterdam are among the riskiest real estate markets, with high prices and significant bubble risk. UBS indicates that further price increases in these cities are in question due to high price-to-income and price-to-rent ratios.

However, in Poland, particularly in Warsaw, the risk of a bubble is very low, with a score of 0.23 compared to 1.79 in Miami and 1.67 in Tokyo.

2. Poland Compared to Europe – Why Investing in Poland is Safe

Poland stands out for its stability among European markets. Compared to cities like Madrid (bubble index 0.56) or London (0.41), Warsaw offers a much more balanced price growth. This means that investments in Polish real estate carry less risk of sharp corrections, making the Polish market more attractive for long-term investors.

“Compared to other European markets, Warsaw exhibits exceptional stability, providing investors with a safe haven without the fear of drastic price corrections.” – UBS Global Real Estate Bubble Index 2024

3. Stability of the Real Estate Market in Poland – Key Data and Numbers

The Polish real estate market in 2024 is characterized by stable price growth. In the first half of 2024, property prices increased on average by 8.5%.

Key cities like Gdańsk, Kraków, and Gdynia are experiencing rising demand, especially in the short-term rental segment. This means that investors can expect stable income from both rentals and property value appreciation.

Investors can count on safer investment conditions without the worry of sharp price corrections, which is a common issue in more overheated markets like Miami or Amsterdam.

4. Advantages of Poland over Other Countries like Spain and the USA

Spain, while popular among investors due to its climate, faces increasing bubble risk. Madrid, with a bubble index of 0.56, and other Spanish cities may be susceptible to sudden price corrections.

In the USA, cities like Miami and Los Angeles are also reaching dangerously high price levels, placing those markets in a precarious position.

Poland, on the other hand, with relatively stable prices and low bubble risk, presents a safer alternative. Investors can expect stable property value growth in the long term, making Poland an ideal market for diversifying their investment portfolio.

“While other European and global markets face bubble risks, Poland offers stable price growth and secure conditions for long-term investors.” – UBS Global Real Estate Bubble Index 2024

5. Conclusions and Recommendations for Investors

The Polish real estate market in 2024 offers stability and attractive investment conditions compared to other global markets. Low bubble risk, stable price growth, and favorable financial conditions make Poland a safe and profitable choice for investors seeking long-term gains. Unlike markets such as Spain or the USA, Poland assures that investments will have solid foundations and predictable returns.

Sources:

Check out other recommended articles